Budgetary

A typical budgeting session involves a financial mentor helping you set goals and make a financial plan. This will include looking at your total debt. You may be asked to bring bank statements and bills to the session so that your financial mentor can help you develop a strong budget.

There are a million reasons why money sometimes becomes a struggle. It may be because of sickness, unemployment, a major unexpected expense, divorce, or a simple case of overspending.

Whatever the reason, when money becomes a struggle it has an enormous impact in almost every other area of our lives. It makes day-to-day living, planning, and spending exhausting. It makes our big picture goals – owning a home, saving enough for retirement – feel impossible.

But none of those things are impossible. We can show you how to make your goals a reality.

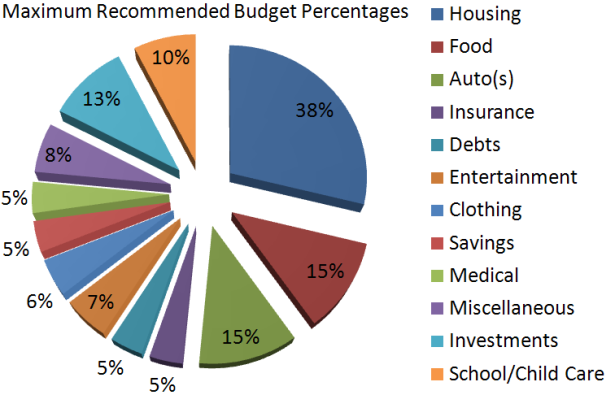

Following the 50, 30, 20 rule is an easy step to take to begin your budgeting plan. We can help you execute this and sort out what’s next.

-

Working with Job was a seamless process. He demonstrated the highest level of professionalism and provided financial advice for one of my businesses. The advice helped me to save money and file my paperwork accurately. Over time, we also became friends as he is trustworthy and an extremely reliable person. I highly recommend his services.

Sianna RamdialProject Manager, Business Owner -

Jules Financial Enterprise is a leader in the financial services industry. They offer a wide array of services and expertise. A team of dedicated, hardworking individuals who care about their clients and reputation. Jules financial will make a difference for you and your business. If you are in the market for world-class service that is second to none…. go ahead and give them a call. You will not be disappointed!

Keisha HarrisCEO, CTS & Consulting -

The best in the market! We have partnered with Jules Financial Enterprise and they do not disappoint. I would like to say thank you for all of your support and partnership.

Evans Williams JulesFounder, Jules Prestigious Group -

“Job is an excellent Financial Advisor. He takes pride in his work and provides a personalized service to his clients. His level of attentiveness shows how much he genuinely enjoys helping people. I would recommend him to anyone looking for a financial advisor who is professional, honest, and works hard to meet your specific needs and concerns.”

Ashley CurryIndependent Business Owner

Task assignment strategy

- Step #1: Evaluation and Communication of The Strategic Plan

- Step #2: Determine Roles, Responsibilities, and Relationships

- Step #3: Set Clear Goals and Define Key Variables

- Step #4 Implementation Structure Development

- Step #5: Execute the Plan, Monitor Progress and Performance, and Provide Continued Support.

The management process is a collaborative, communication-based process where our clients and agents work together to plan, monitor, and review objectives long-term goals while focusing on financial trajectories.

- Step #1: Goal Setting

- Step #2: Analysis

- Step #3: Strategy Formation

- Step #4 Strategy Implementation

- Step #5: Strategy Monitoring